KEUA: Built-in Stability from One of the World’s Largest Carbon Markets

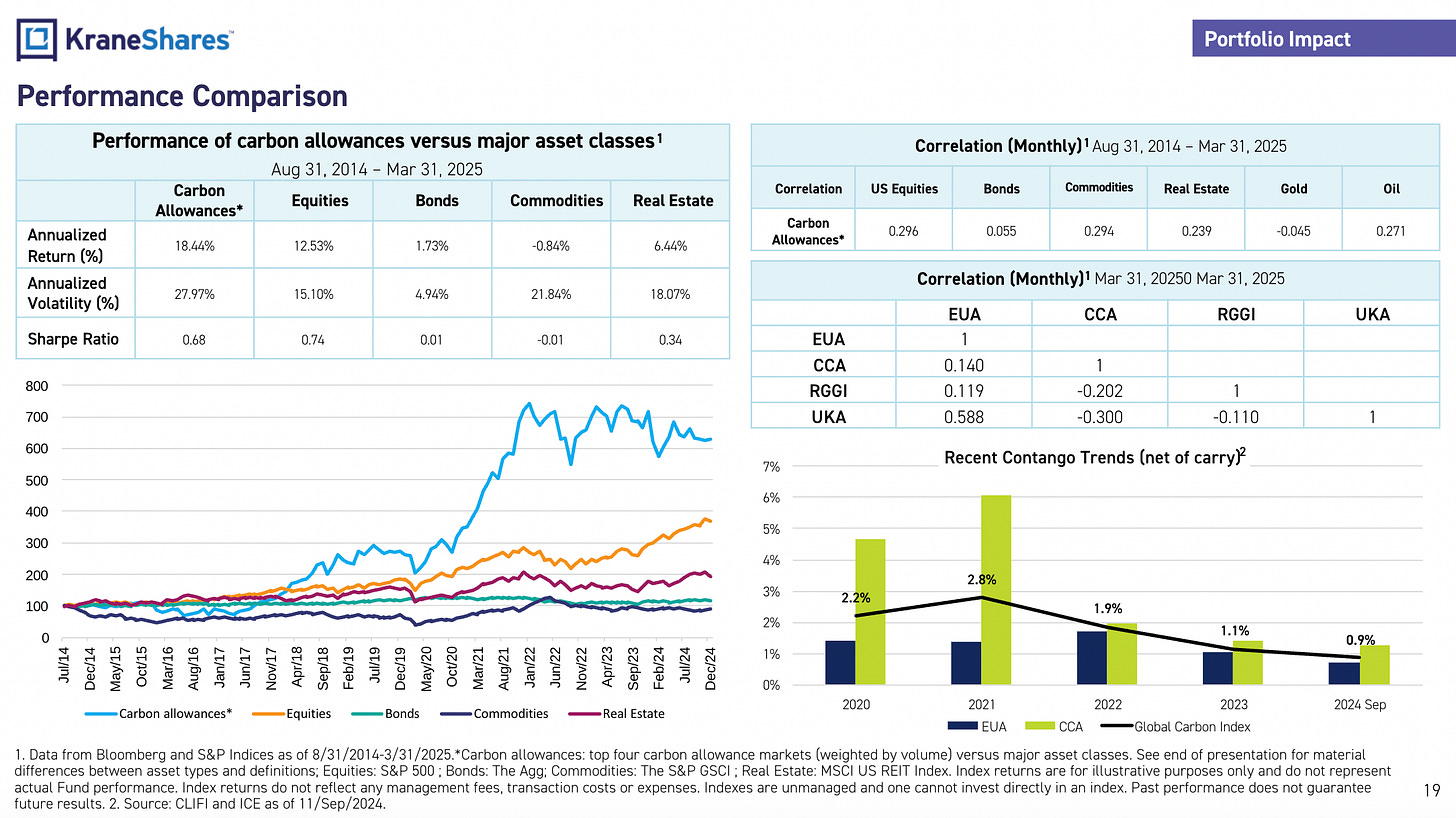

The European Union has created one of the world's largest carbon markets, and recent policy changes are poised to set up what could be a compelling investment opportunity. The EU's Emissions Trading System (ETS) offers diversification and potential inflation hedge via a fairly unique environmental commodity.

Let's dive into Europe's carbon program, see what it looks like and see how investors can gain access to it via the KraneShares European Carbon Allowance Strategy ETF (KEUA).

Understanding Europe's Carbon Program

The EU ETS was launched in 2005 and was the world's first major carbon market. Companies that operate in the enforcement area are forced to buy carbon allowances to cover their excess emissions. They can trade these allowances with each other. This market-based approach is far more flexible than the traditional regulatory method of fining companies or outright banning emissions activities. The ETS currently covers about 45% of the EU's gross emissions across 27 EU countries plus Iceland, Liechtenstein, and Norway.

The numbers are pretty staggering. Over its 20-year history, the program has built incredible scale. This scale provides the kind of deep liquidity that institutional investors require.

KEUA provides investors with exposure to this market through European Union Allowance (EUA) futures contracts. These contracts offer the closest thing to a pure-play investment in this regulated carbon market without the operational complexities of direct allowance ownership.

Aggressive Policy Tightening Creates Supply Scarcity

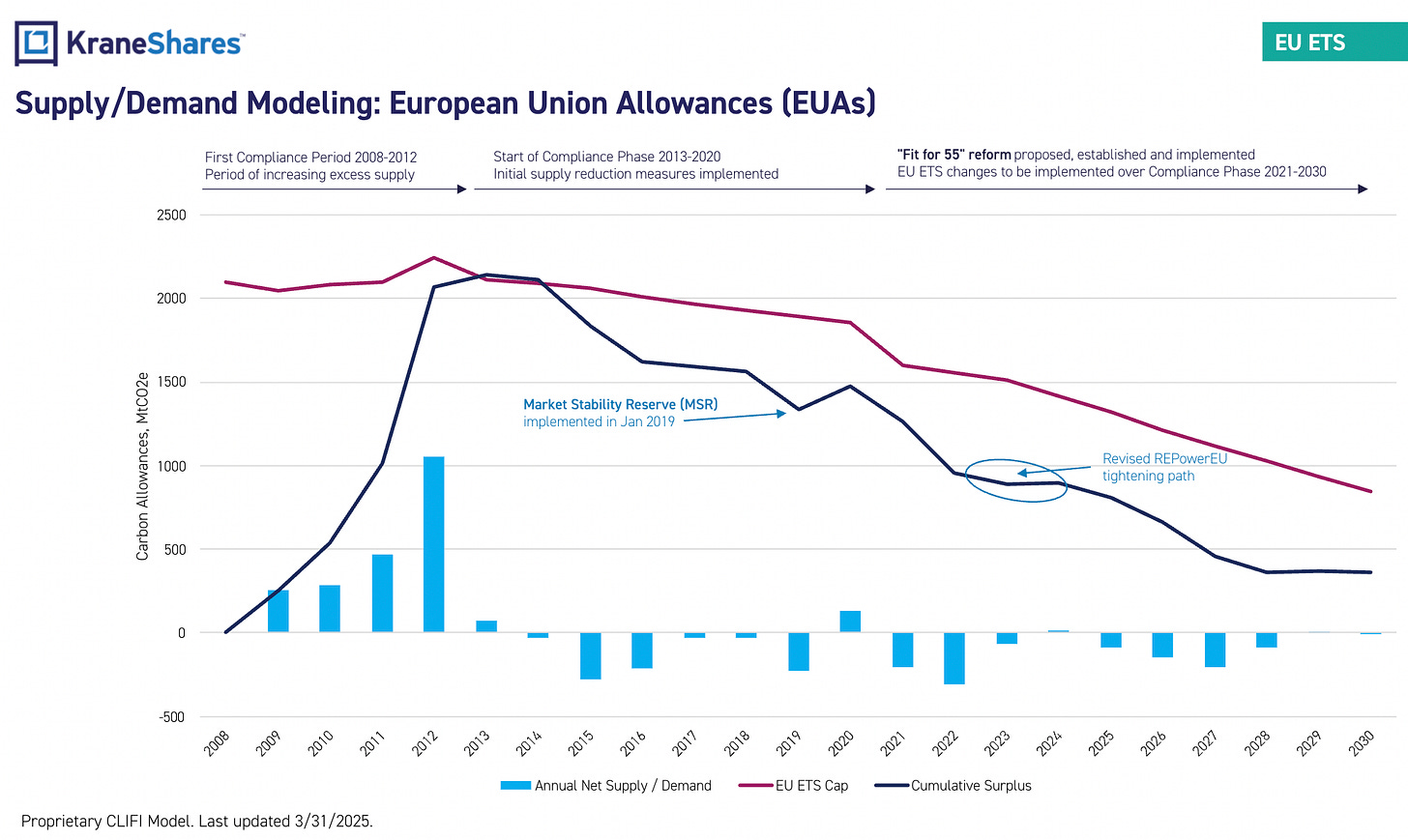

One of KEUA's most compelling features comes from Europe's recently accelerated climate ambitions. The "Fit for 55" package1, which raises the 2030 emissions reduction target from 40% to 55% below 1990 levels has totally altered the supply-demand dynamics in the market.

The annual emissions cap reduction rate was pushed up from 2.2% to 4.3% in 2024 and will move up further to 4.4% starting in 2028. This represents a 20% total EU ETS cap balance decrease between 2024 and 2030.2 That decrease is creating structural scarcity that should support higher carbon prices over time.

Unlike California's explicit price floor, the EU system employs the Market Stability Reserve (MSR) as an automatic stabilizer. When surplus allowances exceed 833 million tons, the MSR withdraws 24% of the excess from circulation through 2023, then 12% thereafter. This mechanism has already removed hundreds of millions of allowances from the market, helping eliminate the historical oversupply that likely previously suppressed prices.

Market Hasn't Priced in the Supply Crunch

While the MSR provides stability mechanisms, there's a real opportunity in the market's underappreciation of the dramatic supply constraints coming through 2030. Proprietary modeling from Climate Finance Partners (CLIFI), a sub-advisor to the fund, shows the cumulative surplus declining rapidly, with the market shifting from structural surplus to deficit as early as 2024-2025.

Leading market analysts are expecting substantial price appreciation as a result. Bloomberg New Energy Finance forecasts EUA prices reaching €71 by 2025, €86 by 2026, and €145 by 2030. Macquarie expects €78 by 2025, €90 by 2026, and €138 by 2030. Even more conservative estimates from Energy Aspects project €80 by 2025, €94 by 2026, and €121 by 2030.

The Carbon Border Adjustment Mechanism (CBAM), which phases in starting in 2026, will further tighten supply. CBAM reduces free allowance allocation and expands the reach of carbon pricing to imported goods. This is likely to create additional structural demand for EUAs as the supply of free allowances to European industry drops.

Strategic Opportunity in the World's Premier Carbon Market

Recent market dynamics have created what appears to be an attractive entry point. The historically high net negative positioning among investment funds that existed in 2023 began to reverse in Q4 2024, with fund positioning turning net positive. This is signaling growing institutional confidence in the market's direction.

The convergence of accelerated policy tightening, sophisticated price stability mechanisms, and massive market scale creates a compelling investment thesis. As Europe leads the global transition to net-zero emissions, the EU ETS serves as both a well-established carbon market and a potential inflation hedge, with KEUA providing accessible exposure to this critical market infrastructure.

We believe that for investors seeking alternatives that can provide portfolio diversification while participating in the clean energy transition, KraneShares European Carbon Allowance Strategy ETF (KEUA) could be seen as a unique opportunity to access one of the world's largest carbon markets at a time when structural supply constraints are creating favorable long-term dynamics.

Note: Diversification does not ensure a profit or guarantee against a loss.

For KEUA standard performance, top 10 holdings, risks, and other fund information, please click here.

Sources:

1 https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal/fit-55-delivering-proposals_en

2 https://www.homaio.com/glossary/lrf

Carefully consider the Funds’ investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Funds’ full and summary prospectus, which may be obtained by visiting: www.kraneshares.com/keua. Read the prospectus carefully before investing.

Risk Disclosures:

Investing involves risk, including possible loss of principal. There can be no assurance that a Fund will achieve its stated objectives. Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. Certain content represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice.

The Fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses. A derivative (i.e., futures/forward contracts, swaps, and options) is a contract that derives its value from the performance of an underlying asset. The primary risk of derivatives is that changes in the asset’s market value and the derivative may not be proportionate, and some derivatives can have the potential for unlimited losses. Derivatives are also subject to liquidity and counterparty risk. The Fund is subject to liquidity risk, meaning that certain investments may become difficult to purchase or sell at a reasonable time and price. If a transaction for these securities is large, it may not be possible to initiate, which may cause the Fund to suffer losses. Counterparty risk is the risk of loss in the event that the counterparty to an agreement fails to make required payments or otherwise comply with the terms of the derivative.

The Fund relies on the existence of cap and trade regimes. There is no assurance that cap and trade regimes will continue to exist, or that they will prove to be an effective method of reduction in GHG emissions. Changes in U.S. law and related regulations may impact the way the Fund operates, increase Fund costs and/or change the competitive landscape. New technologies may arise that may diminish or eliminate the need for cap and trade markets. Ultimately, the cost of emissions credits is determined by the cost of actually reducing emissions levels. If the price of credits becomes too high, it will be more economical for companies to develop or invest in green technologies, thereby suppressing the demand for credits. Fluctuations in currency of foreign countries may have an adverse effect to domestic currency values.

The use of futures contracts is subject to special risk considerations. The primary risks associated with the use of futures contracts include: (a) an imperfect correlation between the change in market value of the reference asset and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the inability to predict correctly the direction of market prices, interest rates, currency exchange rates and other economic factors; and (e) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a loss.

The Fund invests through a subsidiary, and is indirectly exposed to the risks associated with the Subsidiary’s investments. Since the Subsidiary is organized under the law of the Cayman Islands and is not registered with the SEC under the Investment Company Act of 1940, as such the Fund will not receive all of the protections offered to shareholders of registered investment companies. The Fund and the Subsidiary will be considered commodity pools upon commencement of operations, and each will be subject to regulation under the Commodity Exchange Act and CFTC rules. Commodity pools are subject to additional laws, regulations and enforcement policies, which may increase compliance costs and may affect the operations and performance of the Fund and the Subsidiary. Futures and other contracts may have to be liquidated at disadvantageous times or prices to prevent the Fund from exceeding any applicable position limits established by the CFTC. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the Index, changes in interest rates, or factors affecting a particular industry or commodity.

The Fund is subject to interest rate risk, which is the chance that bonds will decline in value as interest rates rise. Narrowly focused investments typically exhibit higher volatility. The Fund’s assets are expected to be concentrated in a sector, industry, market, or group of concentrations to the extent that the Underlying Index has such concentrations. The securities or futures in that concentration could react similarly to market developments. Thus, the Fund is subject to loss due to adverse occurrences that affect that concentration. KEUA is non-diversified.

ETF shares are bought and sold on an exchange at market price (not NAV) and are not individually redeemed from the Fund. However, shares may be redeemed at NAV directly by certain authorized broker-dealers (Authorized Participants) in very large creation/redemption units. The returns shown do not represent the returns you would receive if you traded shares at other times. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns. Beginning 12/23/2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn't available, the midpoint between the national best bid and national best offer ("NBBO") as of the time the ETF calculates the current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The KraneShares ETFs and KFA Funds ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Funds, or any sub-advisers for the Funds.